India’s D2C Market Grows 30% YoY, Poised for $100 Billion Scale

India’s direct-to-consumer (D2C) market has recently entered a high-growth phase, expanding at annual rates of 25–30%. According to recent reports, digital-first brands are reshaping retail by connecting directly with consumers, positioning the sector to approach the $100 billion mark by year-end.

Key Developments

India’s D2C market growth continues to accelerate, supported by rising internet penetration, widespread smartphone adoption, and seamless digital payments. These factors have lowered entry barriers for new brands and improved nationwide reach.

Market estimates suggest the sector is on track to reach nearly $100 billion in value, up sharply from recent years. Food and grocery D2C brands are emerging as a major contributor, accounting for a growing share of total sales.

Consumer electronics, fashion, and beauty remain among the largest D2C categories. At the same time, health-focused and personalised products are gaining traction as consumer preferences evolve.

A notable shift is coming from Tier II and Tier III cities. More than half of new D2C consumers are now emerging from non-metro markets, signalling a broader national adoption curve.

Industry & Expert Context

India is now home to more than 800 active D2C brands, making it one of the world’s most dynamic D2C ecosystems. The sector is also among the most well-funded globally, reflecting strong investor confidence.

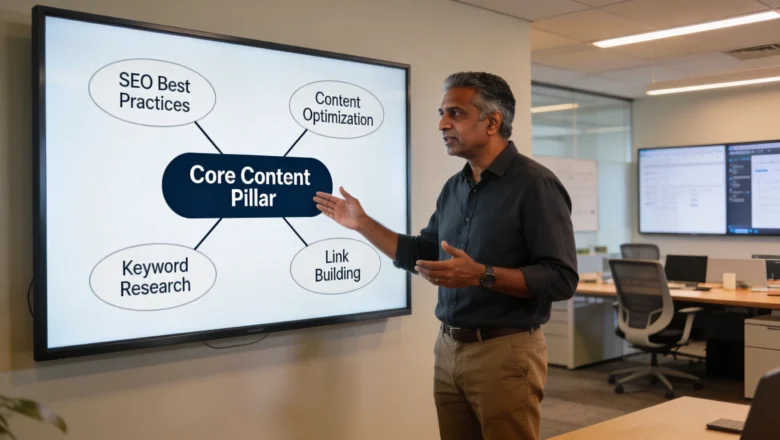

Industry analysts attribute this momentum to a digital-first operating model. D2C brands leverage first-party data, social commerce, and performance marketing to build stronger customer relationships.

Experts also highlight logistics improvements as a key enabler. Faster deliveries, wider pin-code coverage, and easier returns have narrowed the experience gap between metros and smaller cities.

This growth mirrors global D2C trends, but India’s scale, mobile-first behaviour, and price-sensitive consumers create a uniquely competitive environment.

Why This Matters

For consumers, D2C brands offer greater transparency, product innovation, and direct engagement. Shoppers increasingly value authenticity, sustainability, and personalised experiences over mass-market alternatives.

For businesses, India’s D2C market growth presents an opportunity to scale faster without relying entirely on traditional retail intermediaries. Digital channels enable sharper targeting and better margin control.

The trend is also reshaping India’s retail landscape. D2C brands are influencing pricing strategies, product launches, and customer service benchmarks across categories.

At a macro level, the sector is becoming a meaningful contributor to India’s broader digital economy.

What Happens Next

According to recent reports, D2C brands are expected to deepen their omnichannel strategies. Many digital-native players are expanding into physical stores to build trust and offer immersive brand experiences.

Retail leasing data already shows increased participation from D2C brands, particularly in high-footfall urban and semi-urban locations. This hybrid approach is likely to accelerate.

Looking ahead, competition is expected to intensify. Brand differentiation, supply-chain efficiency, and customer retention will become critical success factors.

Regulatory clarity, data privacy, and profitability will also shape the next phase of India’s D2C evolution.

Final Takeaway

India’s D2C market growth reflects a structural shift in how consumers discover, evaluate, and purchase products. As digital-first brands scale across categories and geographies, the sector is emerging as a defining force in India’s retail future.

Digilogy tracks these developments closely to understand how D2C growth is transforming digital commerce and brand strategy in India.