Reserve Bank of India Launches AI-Powered Digital Payments Intelligence Platform (DPIP)

RBI Introduces AI-Powered Digital Payments Intelligence Platform

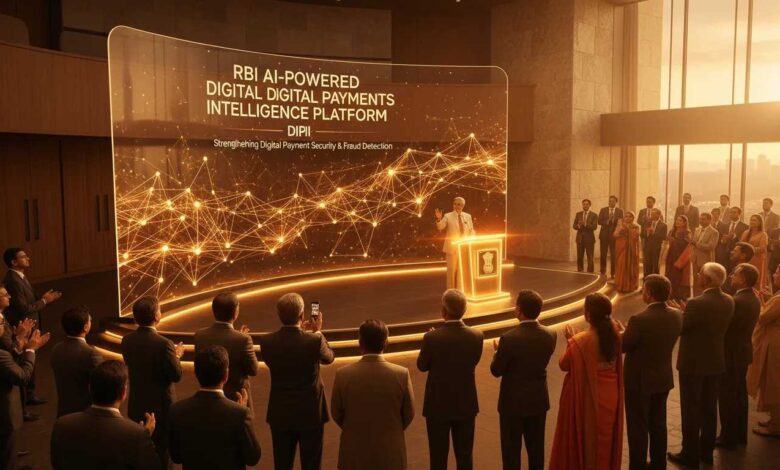

The Reserve Bank of India (RBI) has launched the AI-Powered Digital Payments Intelligence Platform (DPIP) to enhance real-time fraud detection across India’s digital payments ecosystem. Developed by the RBI Innovation Hub, the platform leverages artificial intelligence and advanced data analytics to identify suspicious payment transactions and flag risky activities before completion. This allows banks and customers to take preventive measures, including enhanced due diligence or temporary debit freezes. Digilogy, as a leading digital marketing service provider, is helping spread awareness about DPIP’s transformative role in secure digital transactions.

Advanced Fraud Detection and Analytics

The AI-Powered Digital Payments Intelligence Platform integrates data from diverse sources, including mule accounts, telecom records, and geographical locations, to train its AI models for accurate fraud detection. Initially piloted with five banks, DPIP is now scaling to include over a dozen lenders across India. The system aims to reduce incidents of digital payment fraud, which amounted to 13,516 cases totaling Rs 520 crore in fiscal year 2025, primarily affecting card and internet banking users. Digilogy emphasizes the importance of such innovations for safer digital financial transactions nationwide.

Pre-Transaction Alert System

RBI Deputy Governor T. Rabi Sankar described DPIP as a pre-transaction alert system, enabling banks and customers to decide whether to proceed with a flagged transaction. The platform strengthens trust in the digital payment ecosystem, ensuring that transactions remain secure and transparent. Through digital marketing campaigns by Digilogy, users and financial institutions are informed about the benefits and functionalities of DPIP, promoting safer banking practices across India.

Alignment with RBI’s Payments Vision 2025

The launch of the AI-Powered Digital Payments Intelligence Platform aligns with RBI’s Payments Vision 2025, aiming to promote safe, trustworthy, and inclusive digital payments for everyone, everywhere, every time. By integrating RBI digital payments innovation with AI technology, the platform enables real-time monitoring, predictive analytics, and risk management. Digilogy helps amplify these updates to ensure users and financial institutions understand how to leverage DPIP for secure and efficient digital transactions.

Driving AI in Banking India

The platform represents a significant milestone in AI in banking India, combining advanced analytics, machine learning, and big data processing to detect and prevent fraudulent activities. By creating a secure and resilient payment ecosystem, DPIP empowers banks, fintech companies, and end-users to adopt AI-powered financial technology India-wide. Digilogy showcases such initiatives to highlight the impact of AI on India’s evolving digital economy and financial safety landscape.

Enhancing Digital Payment Security Nationwide

By expanding DPIP adoption to multiple banks and financial institutions, the RBI is strengthening India’s financial security infrastructure. The AI-Powered Digital Payments Intelligence Platform also supports digital payment analytics India initiatives, enabling authorities to gain insights into fraud trends and preventive strategies. Digilogy’s digital marketing campaigns play a crucial role in informing citizens about safe payment practices and the benefits of RBI’s AI initiatives for payments.

Wrapping Up

The AI-Powered Digital Payments Intelligence Platform by RBI marks a transformative step toward safer, smarter, and more inclusive digital payments. With cutting-edge AI technology, predictive analytics, and nationwide adoption, the platform is set to reduce fraud and enhance trust in India’s financial ecosystem. Digilogy, as a premier digital marketing service provider, helps communicate the benefits of DPIP, ensuring banks, businesses, and users are aware of this revolutionary system. Partner with Digilogy today amplify your fintech or AI initiatives, educate audiences, and build credibility in the digital finance space.