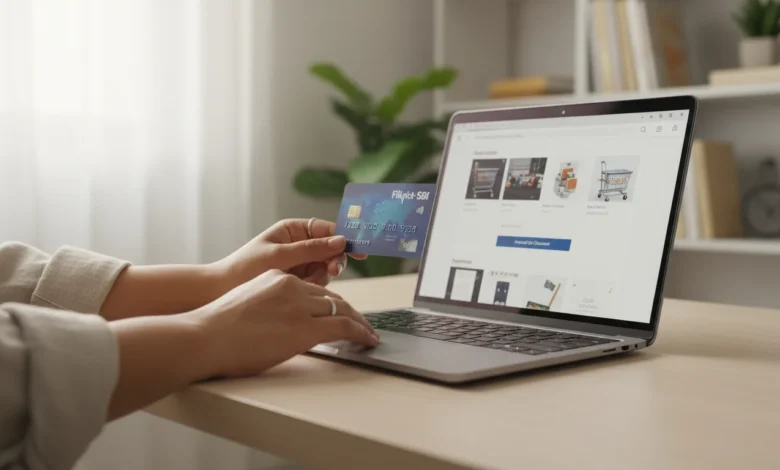

Flipkart and SBI Launch Co-Branded Credit Card for Exclusive Online Rewards

Redefining Digital Payments in India

In an era where digital transactions dominate everyday life, Flipkart and the State Bank of India (SBI) have joined forces to launch a new co-branded credit card designed exclusively for online shoppers. This partnership aims to simplify payments, boost rewards, and strengthen consumer trust in India’s growing e-commerce ecosystem.

The co-branded credit card comes with benefits tailored for digital-first consumers — cashback on Flipkart purchases, extra rewards on partner platforms, and no-cost EMI options across thousands of sellers. For millions of users who rely on online marketplaces, this collaboration bridges convenience with financial empowerment.

Why Co-Branded Credit Cards Are the Future

The rise of the co-branded credit card isn’t just a financial innovation — it’s a lifestyle upgrade. By aligning payment systems with brand loyalty, companies like Flipkart and SBI are creating more personalized experiences for consumers.

With this launch, Flipkart ensures that frequent shoppers gain from every transaction, while SBI enhances its digital footprint among young, tech-savvy users. Together, they’re setting a benchmark for how financial institutions and e-commerce brands can collaborate in a mobile-first economy.

Exclusive Rewards Tailored for Shoppers

The new co-branded credit card offers some of the most competitive rewards in the market. Users can earn accelerated cashback on Flipkart and Myntra purchases, along with bonus points on travel, dining, and lifestyle categories.

Additionally, cardholders enjoy instant discounts during major Flipkart sale events, giving them more value with every purchase. Beyond just saving money, the co-branded credit card creates a sense of belonging to a community that values smart, digital-first spending.

Simplified Digital Experience

What sets this co-branded credit card apart is its seamless integration within the Flipkart app. Customers can apply, activate, and manage their card entirely online without visiting a bank branch.

The intuitive dashboard allows users to track spending, redeem points, and access exclusive offers — all in real time. This frictionless experience aligns with India’s push toward a cashless economy, where digital convenience is as important as financial security.

SBI’s Role in Strengthening Financial Inclusion

For SBI, this co-branded credit card reflects its commitment to innovation and accessibility. As India’s largest bank, SBI’s partnership with Flipkart allows it to reach millions of new-age customers who prefer digital-first banking solutions.

By combining SBI’s trust with Flipkart’s digital influence, the co-branded credit card introduces a modern, secure, and rewarding payment solution that appeals to both urban and semi-urban audiences.

Building Trust Through Partnership

One of the major advantages of this co-branded credit card is the credibility it carries. SBI’s financial reliability, paired with Flipkart’s market reputation, builds immediate confidence among users.

This synergy demonstrates how powerful partnerships can redefine customer engagement. The co-branded credit card is more than a payment tool — it’s a loyalty engine that deepens long-term relationships between consumers and brands.

The Future of Reward-Driven Commerce

The launch of this co-branded credit card marks the beginning of a broader trend where e-commerce platforms collaborate with banks to deliver tailored financial solutions.

As India’s online consumer base grows, we can expect more brands to adopt similar models — offering dynamic rewards, flexible EMIs, and personalized financial products. The co-branded credit card is at the heart of this evolution, driving both digital adoption and customer satisfaction.

Empower Your Brand with Digilogy

At Digilogy, we help brands and financial institutions build powerful digital experiences that connect with today’s consumers. From loyalty marketing to omnichannel campaigns, our expertise ensures your business adapts seamlessly to the future of digital engagement. If you’re ready to transform your brand’s digital presence and connect smarter with your audience, take the next step with Digilogy now — where strategy meets measurable growth.