Regulatory Relaxation Lets Banks Advertise Post-Login — Broadening Digital Ad Inventory in Financial Services

What Happened — RBI Eases Digital Ad Restrictions for Banks

In a significant move, the Reserve Bank of India (RBI) has relaxed its digital advertising norms, allowing banks to run ads directly on their digital banking platforms post-login. Previously, financial institutions were prohibited from displaying any form of advertisements or promotions to customers after they logged into their accounts.

The relaxation means that banks can now feature product promotions, financial offers, and other marketing content directly within the apps or websites, without needing prior permission from RBI for new digital ad channels. This change is set to open up a new advertising inventory in the financial services sector, allowing banks to leverage their digital platforms for targeted marketing.

Key Insights from RBI’s Digital Ad Relaxation

1. New Revenue Streams for Banks

By allowing ads on their digital banking platforms, banks can generate additional revenue from advertisements without impacting the core customer experience. This also gives them the opportunity to cross-sell financial products like insurance, loans, and investment services in a more targeted manner.

2. Targeted Advertising on Digital Platforms

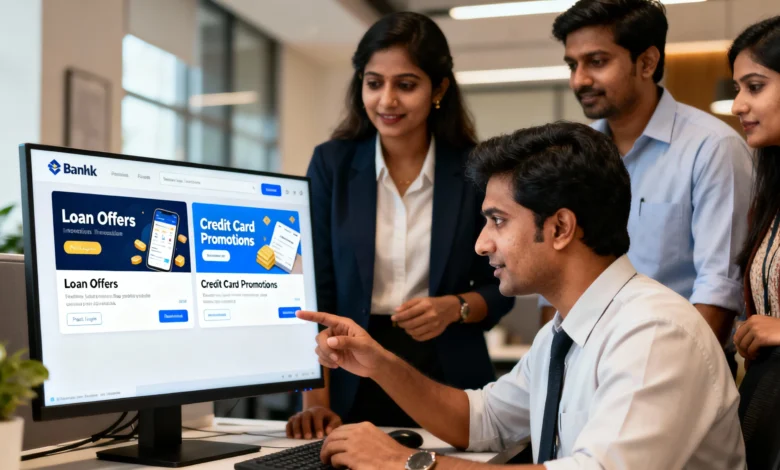

Financial institutions can now target existing customers with specific products that match their financial profile, increasing ad relevance. By displaying personalized offers such as credit card promotions or loan deals within the secure post-login environment, banks can improve engagement and drive conversions.

3. Enhanced Marketing Opportunities for Financial Products

This change opens up massive opportunities for marketing financial products like loans, insurance, and investment opportunities to a highly engaged audience. Given that customers are already logged into their banking portals, they are more likely to trust and act on relevant offers.

4. New Challenges and Compliance Needs

Although the relaxation creates new opportunities, banks will need to ensure that they adhere to compliance standards and maintain privacy while delivering these ads. The need for clear consent management systems and ethical advertising practices will be more crucial than ever.

Why This Matters for Financial Service Marketers

1. Growth in Ad Spend for Financial Services

With the RBI lifting restrictions, the financial services sector is now poised to witness a surge in digital ad spend. Banks and insurance companies can now fully utilize their digital banking platforms as part of their advertising strategies, giving them a powerful way to reach existing customers and promote tailored offerings.

2. New Digital Engagement Channels

Financial institutions can now use their post-login platforms as another digital touchpoint to engage customers in a non-intrusive, high-ROI manner. This could boost the overall effectiveness of digital campaigns by offering timely promotions to users in a secure, trusted environment.

3. Better Ad Performance for Banks

Banks are increasingly moving towards digital-first strategies. This regulatory shift allows them to integrate ads into their existing ecosystem, boosting ad performance by capitalizing on highly targeted, contextual content. Such targeted campaigns can increase customer loyalty, deepen engagement, and generate higher revenue per customer.

How Brands Should Respond Now

- Review Digital Banking Platforms to identify ad placement opportunities.

- Work with ad-tech partners to optimize targeted ads within digital banking platforms.

- Implement compliance and transparency practices to ensure customer privacy and trust.

- Focus on personalized financial product promotions that align with customer needs and financial profiles.

Where Digilogy Fits In

At Digilogy, we specialize in creating targeted digital marketing strategies for financial institutions. We help you optimize your digital ad strategy, from personalized customer journeys to ad targeting and compliance management.

Let Digilogy guide you through this new opportunity. Take the next step with Digilogy today and tap into the full potential of post-login digital marketing.