India’s Digital Media Ad Spend Expected to Cross ₹2 Lakh Crore by 2027

According to recent reports, India’s digital media ad spend is projected to cross ₹2 lakh crore by 2027, reflecting a structural shift in how brands allocate marketing budgets. Mobile-first consumption, video growth, and platform-led advertising models continue to accelerate digital’s share within the broader advertising ecosystem.

Key Developments

India’s digital advertising market crossed INR 571 billion in 2024 and is expected to reach INR 957 billion by 2027, growing at a compound annual growth rate of 19 percent, according to EY.

The widely cited ₹2 lakh crore projection refers to India’s total advertising market, not digital alone. Digital media represents the largest and fastest-growing component within this overall figure.

Digital media has emerged as the largest segment within India’s Media and Entertainment sector, contributing approximately 32 percent of total industry revenues.

Video consumption continues to expand rapidly. Indians consumed nearly 1.8 trillion minutes of video recently, translating to an average of around 3.5 hours per user per day.

Paid video subscriptions currently stand at about 95 million and are projected to grow to nearly 170 million by 2027, strengthening advertiser interest in OTT and connected TV platforms.

Industry & Expert Context

India’s Media and Entertainment sector is projected to grow at over 7 percent annually, reaching INR 3.1 trillion by 2027. Digital media remains the primary growth engine within this expansion.

OTT platforms generated approximately INR 129 billion in revenue recently and are expected to cross INR 185 billion by 2027, supported by subscription growth and advertising-led monetisation.

E-commerce platforms and retail media networks, including marketplace-led ad ecosystems, are also contributing to the rise in digital ad spend through performance-driven formats.

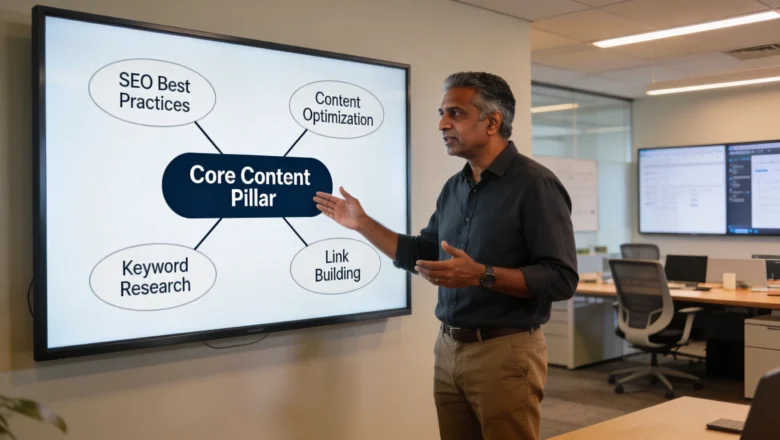

Industry observers, including digital marketing agencies such as Digilogy, track these shifts closely as advertisers rebalance investments from traditional channels like print and television toward data-driven digital platforms.

Why This Matters

The rise in India digital media ad spend by 2027 signals a long-term transformation in advertiser behavior rather than a short-term trend.

For businesses, digital platforms offer improved targeting, measurable outcomes, and flexible formats aligned with evolving consumer habits.

For media companies, the shift accelerates investment in content, technology infrastructure, and audience analytics.

For consumers, increased digital ad exposure raises concerns around ad fatigue, data privacy, and transparency—making relevance and ethical targeting more important than scale alone.

What Happens Next

As third-party cookies phase out, advertisers are expected to rely more heavily on first-party data, contextual targeting, and platform-native insights.

Connected TV, short-form video, and retail media are likely to attract higher budget allocations as brands follow user attention across screens.

Regulatory focus on data privacy and consent frameworks will continue to influence how digital advertising evolves in India.

FAQs: India’s Digital Advertising Growth

Is India’s digital ad market alone worth ₹2 lakh crore by 2027?

No. According to EY, India’s digital ad market is expected to reach INR 957 billion by 2027. The ₹2 lakh crore figure refers to the overall advertising market.

What is driving digital ad growth in India?

Key drivers include smartphone penetration, video consumption, OTT growth, e-commerce advertising, and data-led targeting models.

Which formats are gaining the most ad spend?

Mobile video, OTT advertising, social media ads, and retail media networks are seeing the strongest growth.

Final Takeaway

India digital media ad spend by 2027 reflects a decisive shift toward mobile-first, video-led, and data-driven advertising strategies. As digital cements its role as the dominant growth engine within advertising, clarity around market definitions and data accuracy becomes critical.

Digilogy tracks these industry developments closely. For daily updates and insights, visit the Digilogy News page